DTN Fertilizer Outlook

Fertilizer Prices Declined Sharply in May as Spring Planting Season Wanes

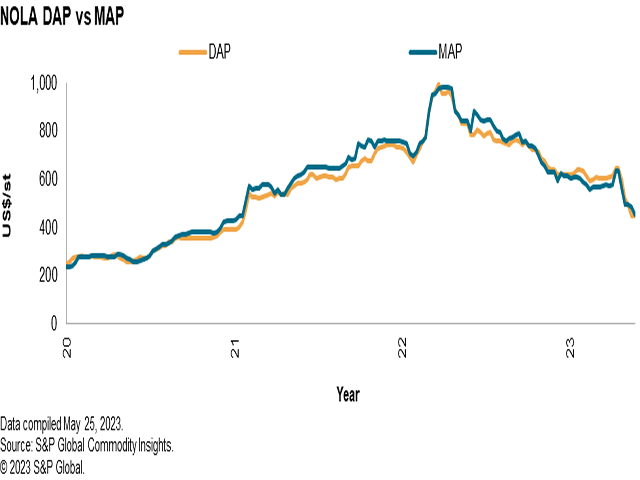

Late 2022 and early 2023 bucked the trend in the phosphate fertilizer market when DAP prices gained a notably premium over MAP. The unusual spread was the result of relative shortages of DAP, which showed a three-to-one ratio of MAP versus DAP imports into the US over the period.

Additionally, there were sharp price declines for fertilizer prices in May, an industry-wide phenomena caused by the spring planting season nearing its end and most commodity fertilizers seeing price declines following the main demand period in late April having passed.

The following is a recap of fertilizer price trends and market developments for May:

AMMONIA

Domestic: The U.S. fertilizer market continued seeing cheaper landed ammonia prices throughout May as the bulk of anhydrous ammonia pre-planting applications had finished by the end of the month. Spot business more or less came to a close, and sellers with inventory were forced to lower their offers to offload length before the end of the season.

By the end of May, ammonia pricing in the Corn Belt fell to $475-$550 per short ton (t) FOB (free-on-board, or sales price without transportation costs to the buyer included) -- down from $750-$840 FOB in April. As mentioned above, despite the high demand, falling global ammonia prices in addition to slowing international demand were the chief market factors responsible for U.S. offer levels falling in May.

Those same market forces also depressed prices at ammonia plants, for instance in eastern Oklahoma and western Kansas, which saw offers from area production facilities from as low as $450-$500/t ex-works to by the end of May, down from $475-$500 in late April.

Ahead of the summer fill offers which major ammonia producers would announce this month, however, purchasing was expected to stay on hold until buyers could assess the Q3 ammonia offers and decide whether prices are attractive enough to participate.

International: The cost of natural gas in Europe declined through May, driving down the cost of producing ammonia in the region and weighing on price ideas in the import market for ammonia.

It then came as little surprise that a further month-over-month decrease was agreed by Yara and Mosaic at Tampa at the end of May. The parties settled at $340/mt CFR Tampa for June ammonia shipments, down $40/mt on the $380/mt CFR agreed by Yara and Mosaic for May deliveries.

In wake of the lower production costs in Europe, the assessed cost of importing ammonia into the region declined as well, with as low as $380/mt CFR heard indicatively by the end of May compared to $390-$430/mt CFR in the month prior.

Ammonia in the Black Sea was also assessed lower but on a nominal basis, considering armed conflict in the region is still hampering shipments to the wider world. Last prices for the month of May were framed from $295-$305/mt FOB, down slightly compared to $300-$310/mt FOB in the prior month.

In the east, downtime at the 500,000 mt/year KPI plant at Bontang provided some buoyancy to prices in Southeast Asia. Pricing in the global market overall, however, still hinges on the recovery of ammonia production rates in Europe.

UREA

Domestic: Spring demand is now shifting from preplant demand into side and top dress nitrogen, but it seems the peak demand period for urea has now passed and prices seem poised to soften with the amount of import volume expected in the coming weeks to weigh on falling demand in the U.S.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Urea barges at the trading hub in New Orleans, LA (NOLA) began trading at an extremely wide range during the month of May as demand for immediate shipping fetched a large premium compared with June loading barges -- sometimes to the tune of over $150/t. NOLA urea barges were assessed at $270-$435/t FOB for the week ended May 25, down from the range of $340-$450 at the end of April.

NOLA barges traded back below the $300/t NOLA mark in May for month-forward shipments into June, falling back to pre-spring kick off levels. Other sales closed at $275 as well as $285 after offers from $295 failed to catch buyers. Upriver moving barges continued holding a premium above the prompt market, trading as high as $200 above June ($475/t NOLA), while loaded barges traded in the middle to the low $400s.

Terminal prices at hub locations along the Mississippi River system were heard at a range of $480-$500/t FOB, including at Tulsa, Cincinnati and St. Louis -- mostly flat from April price levels as steady demand kept prices supported through May. Many of the logistics complications from Q1 such as high water and flooding on the Mississippi were also eased by the end of May.

With the main demand season now passed and the summer doldrums beginning to set into some portions of the fertilizer market, urea prices are expected to stabilize and soften in the short term.

International: Weak demand persisted in global urea markets throughout May Most participants present at the International Fertilizer Association (IFA) conference in Prague last month were expecting some further downward price corrections. Demand in the Northern Hemisphere was slow and key markets such as India, Brazil and Latin America had yet to step in.

Prices edged downward in several key markets accordingly, despite seller reluctance to drop prices ahead of the conference. Egyptian sellers were eyeing the next Indian tender as sales into Europe dried up as the application season ends, with prices falling to $320-$330/mt FOB. Brazilian purchases were also slower in May with demand not expected to emerge until late June/July, assessed lower at $300-$310/mt CFR to end May compared to $330-$350 in the previous month.

With India's June 12 tender announced May 31 for 800,000 mt urea, there was some disappointment in the market about lower-than-expected volumes. Prices were expected to be lower than the previous tender from the approximately $330-$335/mt CFR level paid by IPL in its March 3 tender.

UREA AMMONIUM NITRATE (UAN)

The UAN application season in the U.S. had a shorter run than some in the market had expected last month, and with May showers, market prices continued to fall.

By the end of May, NOLA UAN prices were assessed at $255-$260/t FOB, down from $260-$270/t FOB in early May. Prices were said to be biddable even lower towards the end of the month as applications finished for the spring, as NOLA barges by this time were too late to make it to the U.S. interior in time to meet spring needs.

River terminal offers ended May at a range of $265-300/st FOB, down from $300-$325/st FOB in late April and early May. The lower end of the new range was reflective of the more competitive Ohio River market, while higher offers were reported to the south in St. Louis.

Eastern Oklahoma-area UAN production plants were mostly stable through the month, having been offered at the end of April from $290/t ex-works at the low end to as high as $310/t in the area. Posted offers would eventually see further declines to $285 by the end of May, but downside was limited as side dress demand provided some support.

Some top and side dress demand may help to limit some downside in the market during the summer but falling urea and ammonia prices will apply some inverse forces on the nitrates market, especially later into July and August.

PHOSPHATES

Domestic: The value of MAP in the U.S. continued to decline in May. However, MAP prices are now stronger comparatively to DAP, restoring the historical balance while flipping the inversion observed over the past six months of DAP prices surpassing MAP. This was the result of an import ratio of three times the amount of MAP imports versus DAP in Q4 2022 causing a shortage of the latter, according to Fertecon data.

NOLA MAP barge sales declined from the $499-$625/t FOB NOLA range assessed in late April, down to $450-$460/t at the end of May. DAP prices meanwhile declined by a sharper degree from a wide range of $515-$646/t FOB NOLA in April down to $450/t FOB during the same period.

Similar to the NOLA market, phosphate pricing at Mississippi River terminals also fell last month while the DAP to MAP premium shifted. River terminal pricing came down sharply in St. Louis after prices spiked in late April/early May due to tight supplies, which raised prices to as high as $720/t DAP and $700/t MAP. Offers at the end of May were relieved to levels as low as $$625/t FOB for both products.

With the MAP to DAP price spread moving closer once again to its historical norm, the U.S. phosphates market seems to be rebalancing its supply and demand fundamentals but gives an impression of short supplies heading into the summer.

Buyers are expected to continue retreating from the market while awaiting summer fill offers from large sellers.

International: DAP import demand prospects looked to have improved significantly last month in India, a key market for world phosphate suppliers. Greater clarity on the country's nutrient-based subsidy system suggested high import margins in the coming months and domestic production is more expensive than imports.

India continued to provide the main outlet for phosphates in the phosphate market in May, but with anticipated demand in Southeast Asia deferred, values for DAP dropped towards the end of May to $495-$500/mt CFR India, compared to $548-$549 CFR at the end of April.

West of the Suez Canal, affordability in Brazil was a hot topic, where the barter ratio of soybean to phosphate/potash fertilizers strengthened, prompting firmer demand and competitive offers to secure tons ahead of the summer deliveries. Prices in May for MAP still fell alongside other world benchmarks, however, to $480-$490/mt CFR, down from $565-$570 in April.

Earlier this year, the US Department of Commerce lowered its preliminary duty rates against Moroccan-origin phosphates from just shy of 20% down to 15%, while the rate for Russian-origin phosphates from EuroChem was increased sharply to nearly 50%. Final rates for both countries, as well as a ruling to the pending legal challenge related to the Moroccan phosphates case, are yet to be announced.

Prices in the global phosphates market appeared weaker heading into the summer.

POTASH

Potash barge prices at NOLA were assessed from $390-$400/t FOB at the end of May, $10 higher from the previous monthly report with little new fundamentals at play in the market. Available barge volumes were somewhat constrained as import arrivals tended to be already sold before reaching the open market, which led to the small gain in prices versus April.

River terminal pricing was mostly flat from the previous monthly review in a range of $420-$500/t FOB, with the exception of Oklahoma after prices spiked to as high as $520 at the port in Tulsa, owed to a tight period ahead of resupply volumes becoming available. The $80 spread and where a terminal fell in the range determined on whether or not local stocks were depleted, as well as any impacts to resupply river barge arrivals.

Nutrien will delay its planned potash production expansion to 18 million metric tons per year from 2025 to 2026, CEO Ken Seitz told Reuters in May, on account of slower than expected demand and sales volumes compared to last year when it made the announcement. Seitz also said the company could push the timeline back even further if the global market continues to struggle.

Ahead of any forthcoming summer fill announcements major producers may decide to offer, we expect the potash market to remain subdued until preparations for the fall application run begin.

**

Editor's Note: This information was supplied courtesy of Fertecon, S&P Global Commodity Insights.

(c) Copyright 2023 DTN, LLC. All rights reserved.