Todd's Take

A Tough Time of Year For US Soybean Prices

I've been enjoying conversations with folks at the Sioux Falls, South Dakota, farm show this week and found others commenting on how the 2023 season still feels a little surreal. The way we went from corn and soybean crops that were looking close to being lost in late June to a record corn harvest and decent soybean harvest remains difficult to comprehend. Maybe someday USDA will revise those crops lower; but the Dec. 1, 2023, grain stocks report, and prices themselves, support the notion that the harvests were bigger than most expected.

I don't mean to keep beating that dead horse, but I mention it because for many, it is looking like Brazil is also about to have a bigger harvest than expected -- possibly much bigger. For soybean bulls following precipitation totals closely, looking at the records of below-average rainfall and taking in all the pictures of stressed crops on social media, the recent drop in U.S. soybean prices, especially since the start of 2024, is probably becoming another surreal moment, not unlike the U.S. experience we just went through in 2023.

I may be premature in declaring Brazil's success in raising soybeans this season, but current market clues look extremely bearish. July soybeans in the U.S. were trading in a sideways range for the last six months of 2023 with well-defined support at $13. Even with a better-than-expected fall harvest, USDA estimated 245 million bushels (mb) of U.S. 2023-24 ending soybean stocks through the fall, the lowest in eight years. The lower supplies plus strong support of domestic crush demand gave soybeans good bullish potential, even if South America did have good crops.

As we know now, it didn't take long for July soybeans to break support. Central Brazil received broad rain coverage after Thanksgiving and more on the New Year weekend. The first day of 2024 saw July soybeans fall 26 1/2 cents to $12.86 1/2 and prices haven't been back since. On Thursday, Jan. 25, July soybeans were down 17 cents to $12.35 3/4.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

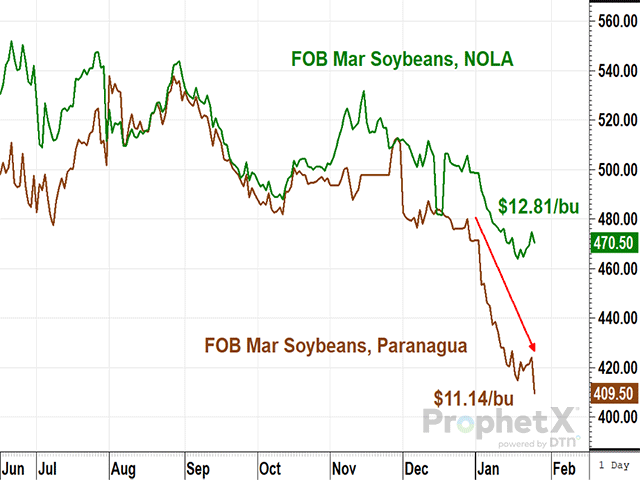

The news has been even more bearish from Brazil where the soybean harvest is just starting to pick up. The bearish news I'm speaking of aren't boots-on-the-ground harvest reports from the field, but the FOB soybean prices for March at Paranagua, Brazil's second-largest soybean port. Translated from U.S. dollars per metric ton to dollars per bushel, the FOB price in Paranagua closed at $11.14 a bushel Thursday, far below the March FOB price of $12.81 a bushel in New Orleans, Louisiana.

In Paranagua, the price drop has been remarkably sudden and sharp. Prices that were trading around $12.95 a bushel near Christmas fell to a new low on Dec. 29 and then dropped like a rock in the first 18 days of January. Thursday's close of $11.14 took prices to a new low for the season. Happening suddenly after central Brazil received beneficial rains over the New Year weekend and now, seeing another new low as early harvest starts to trickle in, it is looking more and more like the market is expecting a big harvest.

USDA's current estimate for Brazil's soybean production is 157.0 million metric tons (mmt) or 5.77 billion bushels (bb) and is fairly close to Conab's estimate of 155.3 mmt. Private estimates have been lower and, given the range of guesses, my personal dart has been in the low 150s. I admit I'm not a fan of the guessing game, knowing that we humans aren't very good at it, no matter how much weather data or boots-on-the-ground reports we take in. Brazil is a big place with a wide range of soils and climates and we humans have plenty of our own problems. To me, price clues at harvest time are worth more than all the pictures on Twitter and that is why I'm concerned about lower soybean prices ahead, at least in the near term.

In the bigger picture, U.S. soybean supplies are not as plentiful as they were through the bearish span of 2014-20 and input costs are 31% higher than they were during that time. Thanks to strong domestic crush demand and commercials holding their largest net-long position in soybeans since 2019, I have a difficult time seeing too much downside potential for U.S. soybean prices. For now, however, there is little argument the bears are in control, and once again, a harvest is looking bigger than we would have expected a few months ago.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

Follow him on X, formerly Twitter, @ToddHultman1

(c) Copyright 2024 DTN, LLC. All rights reserved.