Fundamentally Speaking

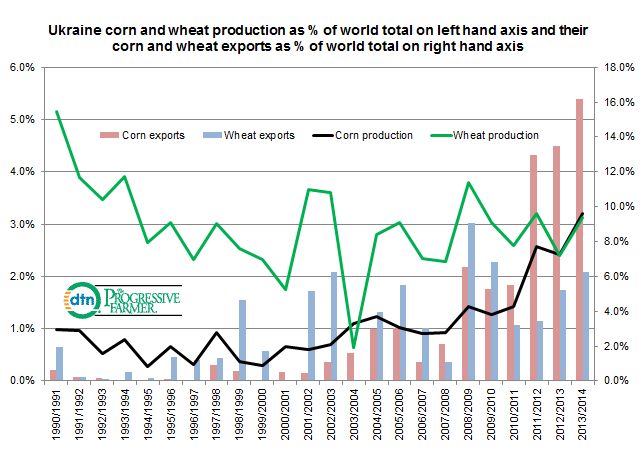

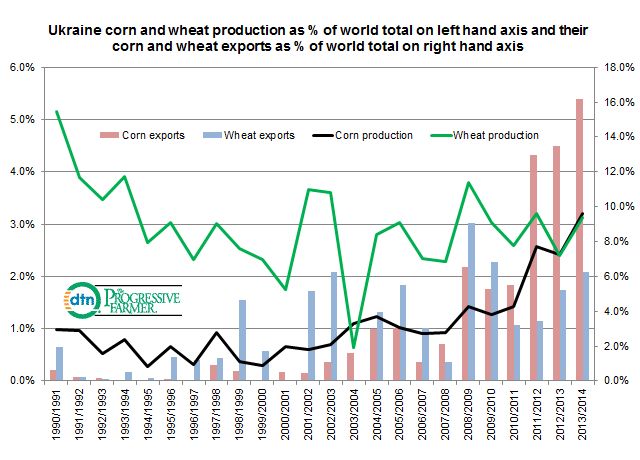

Ukraine Wheat & Corn Poduction, Exports

For corn and wheat, February 2014 was quite kind as the spot contracts of each tacked on about 45 cents last month.

Decent export demand for both along with keen ethanol and feed usage for corn has lowered 2013-14 ending stocks to levels much tighter than what the trade had anticipated just a few months ago.

Strong price action has continued into March supported by turmoil in Ukraine with Russia exerting control of eastern sections of that country and the Crimea.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Prices of both are escalating on fears of the potential impact to Ukrainian wheat and corn exports and upcoming production.

The accompanying graphic tries to quantify their impact on the world coarse grain and wheat markets.

This country has long been known as one of the great breadbaskets of the world as large tracts of arable land along with their warm water ports has made the Ukraine one of the world’ largest suppliers of feed grains and wheat.

Their production and exports suffered in the aftermath of the late 1980’s breakup of the Former Soviet Union but both have bounced back sharply.

Consider than in 2007, Ukraine accounted for a mere 1.1% of global corn and wheat exports vs. 16.2% today for corn and 6.3% for wheat.

This weekend's move by Russia to secure the Crimea and sections of eastern Ukraine have roiled both the financial and commodity markets and drawn the ire of most Western governments as the revival of Cold War dynamics becomes a distinct possibility.

Seasoned observers suggest that neither Russia nor Ukraine desire any slowdown in grain exports needed for hard currency.

Reports suggest port traffic is flowing freely in the main Ukraine facilities and some early spring seeding work is now underway though no doubt the situation remains quite fluid.

(KA)

Comments

To comment, please Log In or Join our Community .