Todd's Take

December Corn Prices Are Down in 2023, But Outcome Not Yet Certain

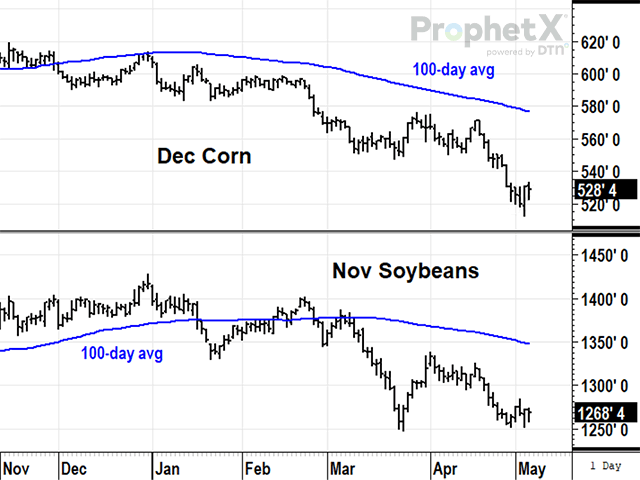

Here in the first week of May, as planting activity is starting to pick up for corn and soybeans, we would normally expect to transition from the quieter price behavior of winter and spring to more active movement that coincides with the excitement of planting and all the uncertainty a new crop season brings. In 2023, we've already seen fairly large price moves in both December corn and November soybeans.

December corn broke lower, out of its winter slumber on the first day of USDA's Ag Outlook Forum on Feb. 23. It's odd to say, but USDA's early estimate that U.S. ending corn stocks would increase from 1.27 billion bushels (bb) in 2022-23 to 1.89 bb in 2023-24 seemed to wake the market up to what many had already been suspecting. Namely, this could be the year corn goes from limited supplies and high prices back to the more familiar environment of large surpluses and low prices. From the end of last year to Thursday, May 4, December corn has fallen over 80 cents to $5.28 1/2. Most of that happened after the Ag Forum, and I can't promise there won't be more to come.

If the U.S. Corn Belt experiences more favorable weather this year, as DTN meteorologists have been predicting, at least 2 bb of ending stocks in 2023-24 are highly likely. Current threats to watch include planting difficulties in the far Northern Plains and dry conditions in the southwestern U.S. Plains, including Nebraska, last year's fourth-largest corn producer, and Kansas, the ninth largest producer.

The possibility of a larger U.S. harvest is not the only influence weighing on corn prices in 2023. From the very start of the 2022-23 season, U.S. corn export sales lagged last year's pace as Brazil's record corn crop from the summer of 2022 crowded out U.S. corn sales for months. It wasn't until mid-March of 2023 when China started buying U.S. corn that sales got a small boost. After 22 million bushels (mb) of Chinese cancellations last week, corn sales on the books in 2022-23 are only two-thirds of last season's total at this time. With China, you never know, but the cancellations in corn may have had something to do with this year's good start for Brazil's safrinha corn crop, expected to hit a record-high 125.0 mmt or 4.92 bb when harvest arrives in July.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A third source of bearish influence on corn prices in 2023 is the level of anxiety traders are feeling over the economy. We saw significant selling for a while last summer when recession fears scared traders out of long positions in corn and soybeans. This year, recession concerns are still nagging after a series of bank failures in March raised concerns about the stability of the financial sector. Wednesday's statement from the Federal Reserve said the banking system was "sound and resilient," but a 50% drop in the stock price of PacWest Bancorp on Thursday signaled all is not well yet.

The wave of speculative selling that started in corn in late February took net longs down to 24,648 contracts as of April 25. The current smaller position should help corn prices weather the storm of economic fears much better than a year ago when specs held nearly 500,000 corn contracts net long. There is no visible reason to believe December corn prices have bottomed yet, but I do suspect it may be difficult for prices to trade below $5.00 until more is known about the new season.

For a contract that started the year above $6.00 a bushel, the 80-cent drop to Thursday's price, while not unreasonable, is also based on a lot of assumptions for a crop that is just getting planted and still has a long way to go. Soybeans saw panicked selling in March during a run of U.S. bank failures and a wave of speculative liquidation in April related to concerns about China's demand and the U.S. economy. Just this week, wheat prices made an unexpected jump on Wednesday after Russia accused Ukraine of attacking the Kremlin with drones. There is a lot of uncertainty as to what will happen in Ukraine this summer and no one knows if the Black Sea Grain Initiative will be extended.

What I am trying to say is, despite big early losses in new-crop corn and soybean prices, the new row-crop season is just getting started. The first four months of 2023 have mostly been on a one-way trip down for December corn, but given the current volatile environment, it wouldn't be out of character for prices to mount at least one sizeable rally this summer.

DTN already recommended making forward sales for 50% of 2023 production at higher prices earlier this year, but this poker game isn't over yet. For any producer who has yet to hedge or make any 2023 sales, my best advice is to think about getting orders ready for a reasonable level of production at prices good for your farm. As the season progresses and we learn more about this year's corn crop, price opportunities will shrink with each tick of the clock. Here in early May, corn prices are down, but for the moment, the possibilities remain fairly open.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.