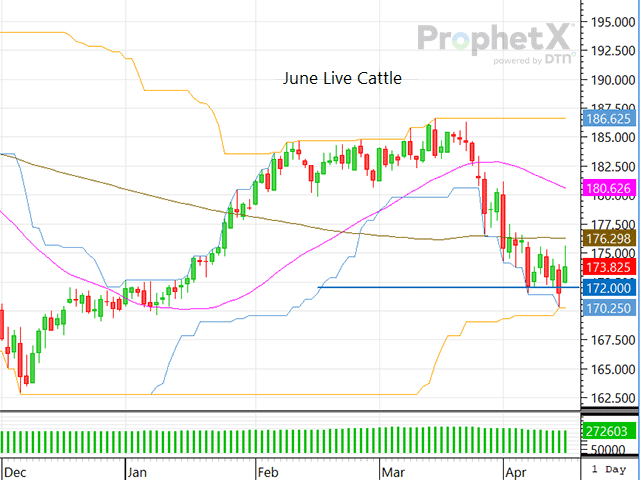

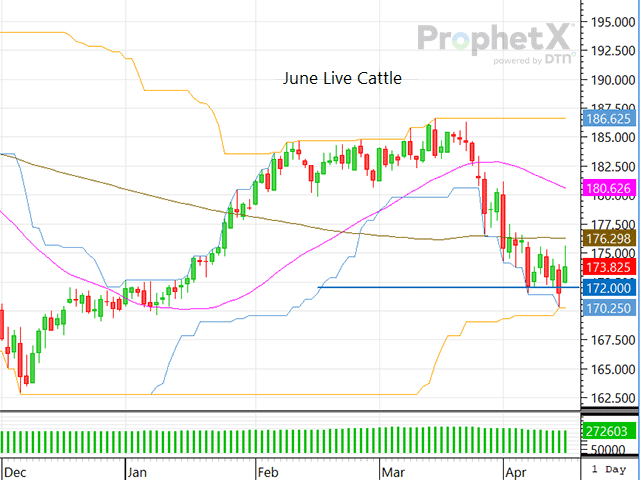

The market could decide to change direction, but the support plane of $172 is a critical focal point and worthy to note regardless of which way the market trades.

Oil futures nearest delivery on the New York Mercantile Exchange and Brent crude on the Intercontinental Exchange settled Friday's session...

CHS Inc. and Cargill signed an agreement on Tuesday for CHS to buy eight grain facilities in five states. The financial terms of the agreement...

DTN's View From the Range series looks this time at how having a proper vaccination program helps keep good health in the cattle. Communication...

P[] D[0x0] M[0x0] OOP[F] ADUNIT[] T[]

ShayLe Stewart is the newest member of the DTN analysis team (September 2019), and comes with deep roots in the beef industry.

Based in the high mountain cattle country near Cody, Wyoming, Stewart leads coverage in all areas of livestock and meat production, and brings a true boots-on-the-ground perspective to a livestock marketing world that gets increasingly difficult to navigate.

ShayLe grew up on a cow-calf and haying operation in south-central Montana, where her passion for the beef industry led her to Colorado State University, ultimately to an internship with the United States Cattlemen's Association. Her experiences following markets for USCA were the springboard for her self-produced Cattle Market News website and Facebook outlets. Those weekly reports were a reliable source of compressed, easy-to-understand, digestible market information.

While her background is in the ranching West, ShayLe comes with a solid list of market contacts from around the country. Talking each week to sale barn owners, feed lot managers, and other industry experts, she is able to ask the questions that cattlemen need answered in order to find clarity in a complex and dynamic market.

ShayLe and her husband, Jimmy, run a registered herd of Sim-Angus females, and host an annual bull sale in Powell, Wyoming.

The market could decide to change direction, but the support plane of $172 is a critical focal point and worthy to note regardless of which way the market trades.

The difficult thing about situations like these is that until disease specialists have the time they need to run the tests necessary to better understand this flu variant, panic and fear fly as...

Friday's April 1 USDA Cattle on Feed report isn't expected to ruffle the market's feathers.

The market could decide to change direction, but the support plane of $172 is a critical focal point and worthy to note regardless of which way the market trades.

The cattle futures complex may have fallen, but fundamentally we are still short supply and demand remains strong. It will likely take the futures complex some time to regain its focus, but the facts about those fundamentals...

Fear and turmoil surrounding the HPAI flu could be the market's focus for another day or another month. Whatever the timeline may be, the cattle market will continue to trade five days a week and fear shouldn't be the market's...

One would like to think that the market would take bullish news and run with it. But when you study both the live cattle and feeder cattle market's charts, it's hard to demand that the market do much more when historically...

Friday's March 1 USDA Cattle on Feed report is again highly anticipated by market participants, as there are varying opinions on where exactly February's placements will land.

Given the snowstorms that crippled transportation, weekly sale barn auctions and consequently hindered feeder cattle placements in January, it should be common knowledge there were higher placements in February.

When you look at the feeder cattle market's continuous chart, you'll see the market scored an all-time high at $257.38 on Sept. 15, 2023. The market currently is trading at $249.28, just a mere...

I wish I could come to you early this week and share that packers are going to increase processing speeds to keep up with increasing consumer demand; however, that simply isn't the case.

On one hand, packers will want to keep just enough product available to consumers that prices stay high. On the other hand, if they produce more meat to try to capitalize on strong boxed beef prices, they'll likely have to buy...

With harsh winter weather conditions prohibiting sales across the majority of the nation for a full week in January, it's hard to believe placements were only down 7% in Friday's Cattle on Feed report.

The cattle industry and market will be watching Friday's Feb. 1 USDA Cattle on Feed report to see just how low the placements were in January.

I understand whenever the market begins to trend lower -- as it did earlier this week -- we question ourselves and the bullish outlook. However, sound fundamental outlooks shouldn't be overridden by knee-jerk reactions.

With the beef cow herd dramatically reduced, some feeder cattle buyers have already begun to buy grass calves.

Declining carcass weight is likely the reason packers were willing to buy Kansas-based cattle last week for $4 to $5 more than the previous week's weighted average while they were only willing to advance prices in Texas by $3.

The Cattle Inventory report released Jan. 31 and the cold storms endured through January will both affect the market moving forward and should not be overlooked.

Wednesday afternoon's Cattle Inventory report and the cold storms endured through January will both affect the market moving forward and should not be overlooked.